Two Wall Street Journal articles recently crossed the wire that reinforce the overriding themes in my book: mutual funds stink, and no one can do a better job managing your financial assets than you can because no one cares more for your financial well-being than you do. Let the following stream of consciousness serve as proof positive.

The first article, When Funds Insult Their Clients, reports that as of December 19, 2014 “more than 79% of U.S. stock funds had failed to beat their market benchmarks for the year.” That stinks – but it’s not the end of the story.

The article goes on to highlight several mutual funds that are lagging well behind the S&P 500 and passing huge tax bills onto their clients even though investors haven’t sold a share of the fund. In other words, clients are paying huge taxes for no economic gain and lackluster market performance.

Take the Janus Forty fund S class (symbol JARTX), for example. On December 17 – just eight days before Christmas – the fund distributed $14.20 of taxable gains per share onto its owners. At the time the fund was lagging the S&P 500 by nine points. The distribution, a whopping 34% of the fund’s value, forced investors to sell a portion of their position to cover the tax bill. The flood of Janus Forty redemptions sent the share price tumbling.

The economics for the Janus Forty fund is dismal.

Consider an investor owning 500 shares at the beginning of 2014 when the share price was $40.22, at which time total value for 500 shares was $20,110. On December 17, the day of the capital gains announcement, the fund opened at $41.95 and then went straight to $28.64 – the first chance ordinary investors had to sell or get out. Fifty shares had to be sold to cover the tax bill in this example. After that transaction the investor was left with 450 shares of JARTX valued at $12,888 – a 36% drop in value from the beginning of the year – and well below its benchmark index, the S&P 500, which had gained 13.8% at the time. Below are the numbers in table form.

| Janus Forty S Class (JARTX) | Change in Value | |||||

| Price | Shares | Value | Action | $ | % | |

| 2014 Open | $40.22 | 500 | $ 20,110 | Held | ||

| Day Before Announcement | $41.95 | 500 | $ 20,975 | Held | ||

| Day of Announcement (12/17/14) | $28.64 | -50 | $ (1,432) | Sold | ||

| Day After Announcement | $28.64 | 450 | $ 12,888 | Held | $ (7,222) | -36% |

That’s an ugly performance tally – but not the extent of mutual fund ill-will. The Janus Forty is just one mutual fund in a market littered with many exactly like it. The price for underperformance is as expensive as it is maddening.

The Lose Your Broker method is easy to understand, simple to use, and consistently produces superior performance. In fact, since publication I have yet to meet a person who has read LOSE YOUR BROKER NOT YOUR MONEY and can’t construct a portfolio that greatly outperforms the S&P 500 and Dow Jones Industrial Average.

Mutual funds are below-average investment products.

And because brokers recommend owing them is the first case in point why they can’t be trusted. Additional proof of this was highlighted in the second Wall Street Journal article that recently reinforced the Lose Your Broker message, entitled, Wall Street’s Watchdog Doesn’t Disclose All Regulatory Red Flags.

To make a long story short, the Wall Street establishment created and funds a broker oversight organization called the Financial Industry Regulatory Authority, or Finra. Finra’s mission is to provide investors a means of researching the credibility of their broker or financial advisor. Did I mention Finra is an industry funded organization?

Low and behold, the Wall Street Journal reports that 38,400 brokers have regulatory or financial red flags that don’t appear on Finra. The article features a broker named Bennett Broad, a 35 year veteran of the Wall Street game. During his experience, good ‘ole Bennett “faced 25 customer complaints involving alleged trading abuses, and 15 ended in payouts to clients.” His Finra rap sheet can be found here.

What’s really amazing is that the man is still allowed to work in the industry. He’s currently at Oppenheimer & Co. – no doubt a Finra funder. This is to say that the Wall Street establishment creates a watchdog agency that buries a lot of criminal activity and disregards the rest. As a consequence the Wall Street establishment employs too many people that have absolutely no right or credibility to manage other people’s money. And they don’t care about it, for if they did Finra postings would actually mean something.

Wall Street trains brokers to be slick and cunning. They employ trained con-men to convince unknowing investors that mutual funds are the best things since sliced bread and that one isn’t enough. They promote overreaching diversification through a “basket” of mutual funds that is sold with high hopes but delivers little chance of success. And because the whole industry is built upon these false truths and deception, criminals like Bennett Broad are all too common.

The goal of LOSE YOUR BROKER is to provide investors with the tools and techniques required to outperform the Wall Street establishment. It is meant to empower investors to take control of their financial well-being and achieve success and financial freedom – easily, simply, and comfortably.

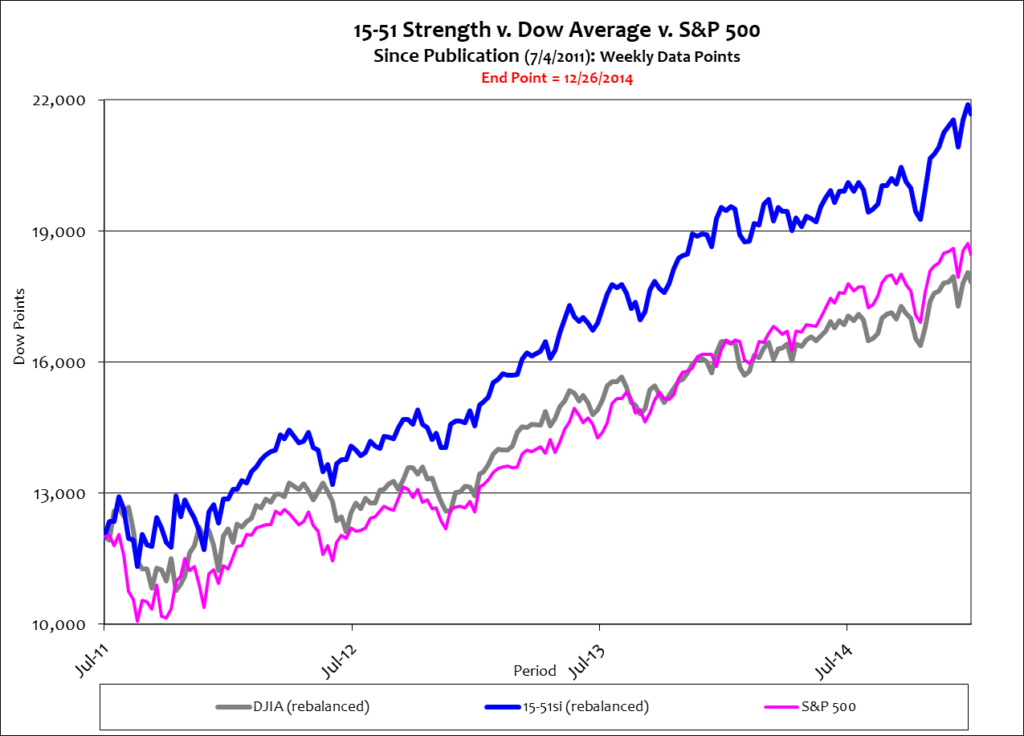

Take my portfolio, for instance, which is built on my patent-pending 15-51 platform. Since its publication the portfolio has outperformed its benchmark index (the Dow Average) by 32% points, 82% versus 50% respectively; and beat the S&P 500 by 26% points, 82% versus 56% respectively (see below.)

And you can do it too. The first step is…