Stocks continue to adjust to the prospects of a significant Trump tax cut. Candidate Trump ran on reducing corporate income taxes from 35% to 15%, and decreasing the highest personal rate from 39.6% to 25%. The million dollar question still exists: What will President Trump be able to get through Congress – and when?

Speculation is that some sort of tax cut can be expected in late summer. But will tax cuts affect both corporate and personal taxpayers? And will they be as dramatic as candidate Trump advertised?

No one knows.

In any event, it is important to understand the dynamic of what Trump wants to implement. Let’s take the corporate income tax situation first.

Such a change (from 35% to 15%) represents roughly a 30% change in net earnings. That amounts to an according 24% decrease in P/E multiples. See illustration below.

| Company A | 35% Tax | 15% Tax |

| Earnings Before Taxes | $500,000 | $500,000 |

| Taxes | -$175,000 | -$75,000 |

| Net Income After Taxes | $325,000 | $425,000 |

| $Change in Net Earnings | $100,000 | |

| % Change in Net Earnings | 30.8% | |

| Share Price | $50.00 | $50.00 |

| Shares Outstanding | 100,000 | 100,000 |

| Earnings Per Share | $3.25 | $4.25 |

| Price/Earnings Multiple | 15.4 | 11.8 |

| Change in P/E Multiple | -24% |

A mere change in tax rate made Company A much more profitable – and thus “cheaper” on a relative basis according to its P/E Multiple.

That’s why stocks have moved higher since the election.

While it’s easy to evaluate a corporate income tax change, the impact of a personal tax reduction isn’t so tangible. Moving the highest rate from 39.6% to 25% represents roughly a 37% tax decrease.—But that’s just for the highest tax bracket; less than 1% of all taxpayers.

The big question regarding Trump’s personal tax scheme is: What do all the tax brackets look like and how equitable are they?

For example, right now there are seven different tax brackets of which 140 million American taxpayers fall. Most Americans (31%) fall into the 15% tax bracket (before deductions).

The top 1% of taxpayers pay 40% of all taxes, and the top 10% pay 70% of the total tax bill. The top 50% of taxpayers pay 89% of all taxes and the bottom 50% pay just 11%. Thirty-seven million, or 27% of all taxpayers, don’t pay any income tax at all.—This, not to mention, that many Americans not only don’t pay taxes but receive a tax benefit (payment) from the IRS via the Earned Income Tax Credit. The EITC costs taxpayers approximately $65 billion per year.

It’s hard to describe this schematic as fair and equitable. Indeed, higher income earners should pay a higher share of the tax bill – but 70%???

The free-market system is driven by one thing: incentive. Provide incentive for people to work, and they will work. Incentivize workers to earn more, and they will work more.

Incentive paves the road to prosperity.

The Trump tax plan has to provide incentive to earners and discourage social welfare. If he does this, and creates a positive environment for job growth, stocks will go on an absolute tear.

More money via less tax payments is the best incentive for earners, and businesses and entrepreneurs to expand. It will lift GDP growth to Trump’s target of 5-6% and investors will applaud with even higher stocks valuations.

To reform the tax code we as a country need to stop talking about arbitrary labels like “rich and poor” and define what the brackets actually mean and who fall into them. For instance, there are four classes of people: upper income, lower income, middle income, and poverty. Logic would dictate that there should be four according tax brackets.

To establish the highest rate we cannot look to national income averages for guidance; that would only lead to over-taxation to the highest earning territories of the American economy. For instance, to define “rich” as those earning $250,000 per year is erroneous and shortsighted – especially for those living and working in places like New York City. Remember, lowering healthcare costs is a major objective of the U.S. central government. To tax all New York doctors as “rich” is to raise the cost of healthcare in that area – along with all other areas with a similar economic dynamic, i.e. California, Illinois, Connecticut, and New Jersey, etc.

Instead, high-earning economic markets should set the bar for classifying taxable segments for federal tax purposes. Note: these segments are also usually confined to the highest taxing states.

A doctor earning $1 million in New York City is not rich. In fact, a higher federal income tax bill for this doctor automatically creates an according price increase for their services. This not to mention that once their cost of living, city taxes, state taxes, federal taxes, Social Security and Medicare, malpractice and payroll taxes are deducted, this doctor is nothing more than a middle class earner, taxed at the richest rate.

But let’s forget about that for a second. Let’s agree on defining upper income earners as those who earn $1 million per year or more. These people will pay the highest federal income tax rate (plus Social Security and Medicare, of course.)

Next we need to define the middle-income earners. This class must represent the largest number of U.S. taxpayers in the population because the middle class is what separates America from the rest of the world. A strong and vibrant middle class is essential to maintaining the American ideal. These people will be largest in number and pay the lion’s share of taxes to the federal government.

If we can agree that high-income earners start at $1 million income per year, then middle class earners must end there. Their starting income should be $100,000 per year. In other words, anything from $100k to $1 million should be taxed at the middle income tax rate.

No way should middle-income earners pay more than one day’s pay (20%) for federal income taxes. That’s outrageous. As is the case when high-income earners’ pay more than two day’s pay (40%). Remember, these taxpayers also pay state and local taxes as well, including sales and gasoline taxes, Social Security and Medicare.

Enough is enough already.

That said, middle-income earners should pay 15% federal tax (plus Social Security and Medicare); high-income earners should pay 25% (plus Social Security and Medicare).

That’s fair.

Lower-income earners, those earning between $100,000 and the poverty level, should pay 5% (plus Social Security and Medicare.) This is consistent with the thought that all taxpayers should have some skin in the game –they should hate paying taxes but believe it is just, and for the collective good. After all, the military protects them too.

Poverty level people should pay zero federal income tax, because as the label suggests, they can’t afford it. They should pay Social Security and Medicare but hardship credits should be available to them on a limited, case-by-case basis.

When tax rates move after establishing these brackets they should move together across the board. If the highest tax rate goes up by 10%, for example, then the lowest rate must increase by that same 10%. This will help minimize the effects of politically motivated class warfare – as will reducing the number of people not paying taxes, or people getting paid to not pay taxes.

The same tax bracket logic should then be applied to corporations. Why should companies the size of Warren Buffett’s Berkshire Hathaway pay the same corporate income tax rate as Mom and Pop Incorporated? That doesn’t make any sense.

High earning companies should pay 15%, middle-income earning companies should pay 10%, and small companies shall pay 5%.

In both classes, individual and corporations, loopholes need to be dramatically reduced and/or eliminated, and tax calculations need to be simplified. This would allow the federal government to significantly reduce IRS staffing and funding.

Also remember that corporations do not pay taxes – they collect them. The price of any good is defined as: Cost + Profit + Taxes. Lower taxes produce lower prices, which would provide further incentive for consumers to spend some of their tax savings. This would add needed lift to the economy – and employment.

If companies are selling more goods, and they are more profitable, they will require more workers. When business expands labor participation increases and wages expand. America sorely needs this dynamic.

And the performance of stocks shows that investors want it too.

According to a recent Wall Street Journal article, “Ordinary investors are buying low-cost exchange-traded funds at a record-breaking pace, adding fuel to the U.S. stock rally. Investors have poured $124 billion into ETFs in [the first two months of] 2017, the most aggressive start since the industry was founded 24 years ago.”

This news arrived on the heels of legendary investor Warren Buffett’s prediction that there is “no doubt” that he will win a bet that a collection of low cost index mutual funds would outperform a basket of hedge funds assembled by asset manager Protégé Partners. Buffett revealed the expectation in his recently released annual letter to shareholders.

The funny thing about this is that Buffett made his claim as if this was some kind of new revelation. Heck, it has been common knowledge since the industry began that the vast majority of professional funds managers fail to reach their stock market benchmark. My book opened with that fact back in 2011. But now that Buffet has finally joined on the concept is somehow novel.

Buffett went on, “The bottom line: When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients,” – as if the fees, not poor portfolio construction, is the reason for their failure.

Individual investors should know upfront that they will gain little by listening to Buffett, nor will his preaching’s enhance their investment acumen. Buffett is a has-been, a walking contradiction, a socialist in free-market clothing.

First, let me qualify the socialist element to that comment. Buffett gave a speech in Switzerland several years ago that condemned capitalism and embraced socialism. He has publically supported George Soros, endorsed Barack Obama, likes Bernie Sanders, and campaigned for Hillary Clinton while backing her plan to raise taxes on the middle class.

Birds of a feather flock together.

Second, in his most recent recommendation Buffett is pushing individual investors to low cost index funds. For the record, index funds – like all other mutual funds – are socialized investment products. They take capital from investors and spread it around the market in a broad, sweeping fashion. This decreases individual empowerment and mutes return.

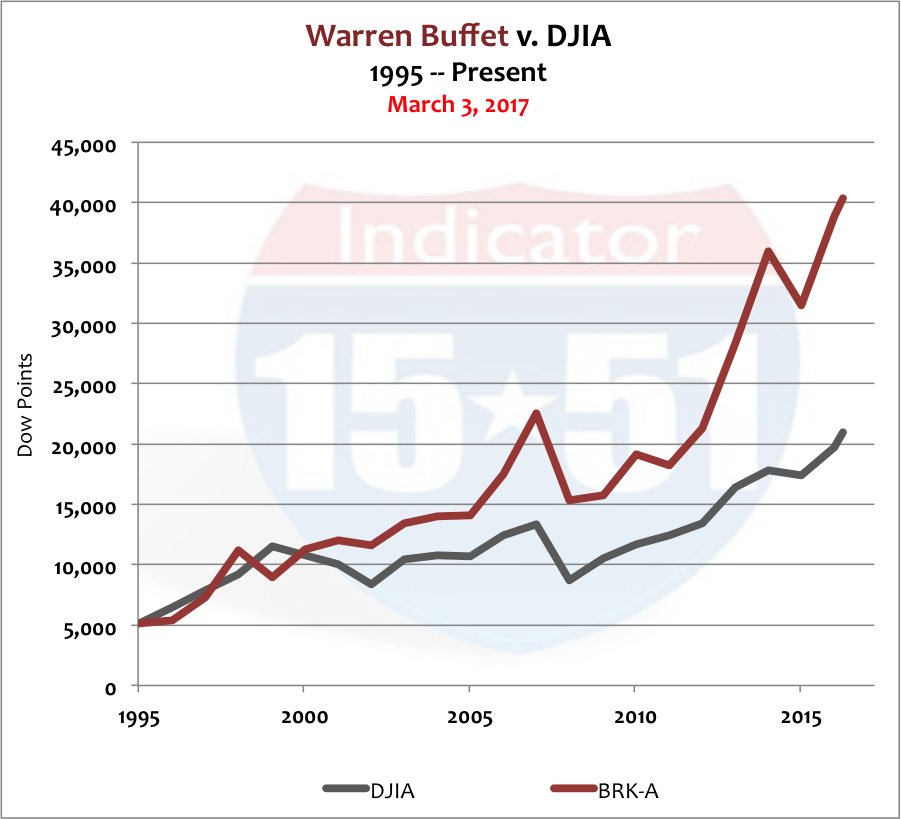

Buffett’s recent annual report boasts a return for his company (Berkshire Hathaway) that greatly outpaces “market returns.” Such a track record earned him the “Oracle of Omaha” title. A chart comparing the returns of Berkshire Hathaway and the Dow Jones Industrial Average from 1995 to present is below.

During this time Berkshire Hathaway more than doubled market returns, posting a 689% gain compared to a 307% advance by the Dow Jones Industrial Average.

That’s pretty good.

So let me ask this: Why would Buffett recommend that individuals invest in index funds instead of owning shares of his company? Berkshire Hathaway is a broadly diversified company, a pseudo mutual fund in its own right. The B shares of Berkshire Hathaway are only $175 per share, and very much affordable to every investor.

Answer: because Buffett is a socialist.

The difference between socialists like Buffett and free-marketeers like me are basic: He promotes market collectives and I advocate practices that empower individuals.

Socialists try to convince individuals that they are better off participating blindly in collectives, dependent on people “smarter” than themselves, to share costs and profits under the guise of “minimizing risk.” Yet they do the complete opposite in their own lives.

Buffett doesn’t blindly hand his investment capital over to others (unless he’s trying to win a meaningless bet, of course). He invests his own money, in companies that produce quality products and services – yet he recommends individuals should hand their money over to others and take whatever the market gives.

Unlike Buffett, I encourage individuals to educate themselves so that they can take control of their financial assets and invest in portfolios that produce exceptional returns with less risk. I contend that this is not only simple to do and understand, but easy to outperform experts and oracles alike (see my book for step-by-step instructions.)

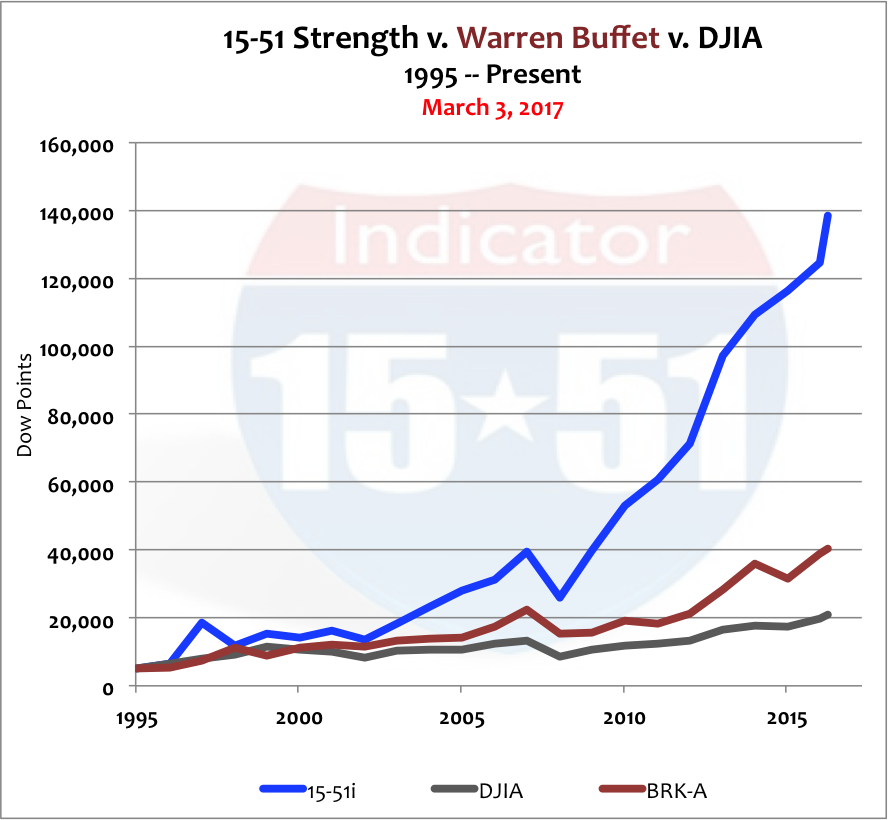

A comparison between my 15-51 portfolio and Warren Buffett’s Berkshire Hathaway can be seen below.

During this time my portfolio has gained an amazing 2,604% return – almost 4 times more than the Oracle’s portfolio.

So when it comes to investment, I say buck Buffett’s advice and build yourself a superior performing 15-51 portfolio.

Stay tuned…