It’s so easy to beat a dead horse. I mean, we can rehash the turmoil in the Middle East and President Obama’s foreign policy failures; we can beat the drum about lackluster global demand and zero growth economies, or we emphasize that point by highlighting the fact that China’s production posted the weakest quarter since the doldrums of the “financial crisis;” or we can lament about the paralyzed status of the U.S. government, the monetary ponzi scheme it has concocted, or its irresponsible fiscal dynamic. Indeed, we can talk about all of that, again, in the same way.

Or we can approach the market condition from a different angle. I was drawn to a recent Wall Street Journal headline, Fed to Hit Biggest U.S. Banks with Tougher Capital Surcharge. Isn’t this ironic, I thought, especially when considering that U.S. banks have been flooded with trillions of dollars of new capital since 2008 and have yet to do with the money what it was intended to do – to be lent to small and midsized U.S. companies to get the economy going. Because of this inaction, one would logically expect banks to have plenty of capital reserves lying around. But apparently that’s not the case, for if they did the Fed wouldn’t have to enact a “charge” on them to encourage larger capital reserves (less lending).

That is to say that Dodd-Frank has done nothing to correct bank practices that led companies “too big to fail” to fail. That is also to say that large U.S. banks continue to do the things that led to the last major financial meltdown.

To combat this poor state of regulatory policy, the Federal Reserve will enact the reserve charge to force U.S. banks to keep more capital on hand (and thus to lend less) to cover future and inevitable losses. The hope here is to avoid blatant taxpayer funded bailouts – because as we know, QE is a discreet way of doing just that – bailing-out banks.

Consider this…

It is common knowledge that the Federal Reserve is currently weighing its options and alternatives to exit QE, a long overdue event. To do so the Fed will have to tighten money and raise interest rates. Economic data, produced by the government mind you, is showing signs of “strength” – unemployment is “down”; economic growth, though weak and uneven, is “stable”; world governance is strained but not yet “failing”; and the U.S. dollar appears to be “strengthening.” And though the Federal Reserve has pointed to an interest rate raise hike in 2015, the aforementioned data points are forcing a debate within the Fed to move sooner.

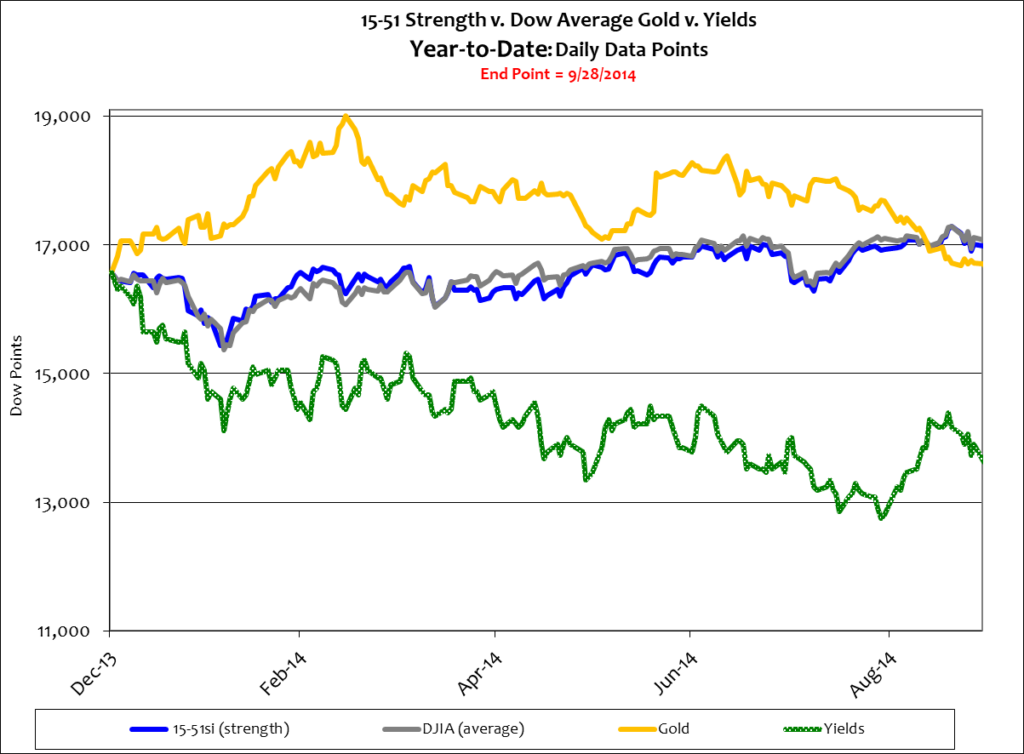

Rates usually rise in advance of a rate hike, but bond yields are low and falling. The 10 year yield is just 2.5%. Below is a year-to-date picture of investment activity. Stocks are up 2% and yields are down 17%; gold, after being as high as +14%, is now up just 1% for the year. Chart below.

Yields are down because institutional investors are scared. The economy is weak and the stock market remains over-heated and near all-time highs. And so grows a sentiment that U.S. bonds, and to be fair German bonds, are “safer than gold.” In other words, investors would rather invest in government debt than commodities at the present time. This temporary dynamic will only last as long as inflation is low and governments remain stable and solvent.

In a nutshell, a flight to “safety” is causing bond yields to fall and a false sense of strength in the currency market is causing gold to move lower. Both are market anomalies. Currency isn’t strong and bonds are loaded with valuation risk, as yields can only move higher from here (a condition that causes bond values to fall).

Owning gold may not look like a “smart” move right now because so many extreme anomalies exist in the markets today. But that’s not why investors own gold. Investors own gold now because they accurately see what’s going on in the markets today, and because they want a hedge to the stock market when it takes a nosedive.

Again, hedging is about having an allocation in an asset class that normally runs in a contrary direction as the portfolio’s core holding. In other words, the hedging asset must increase when the other falls, and vice versa. The hedge now, against stocks and bonds, is gold because gold should fall when stocks are up, and vice versa. That is the current market dynamic.

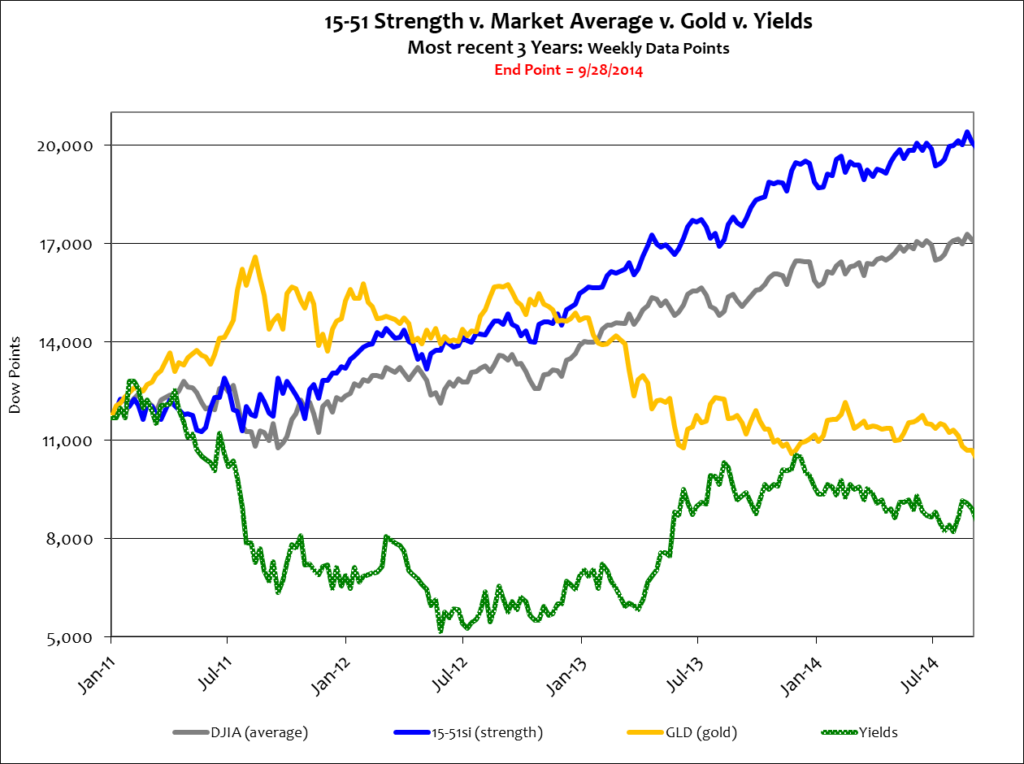

The easiest way to tolerate a falling gold position is to appreciate that it should be falling because the stock trend is rising. This can be seen much clearer in a longer view of the markets. In the last two-plus years the Dow Average is up 14%, 15-51 strength is up 21%, and gold is down 8%. See below.

Again, when stocks go up gold should go down, and vice versa.

Now, I totally understand that it’s easy for new investors to think that there will never be another severe correction, another great opportunity to buy low – and that gold is a dead asset. But if another significant correction doesn’t happen sometime in the near future it will be the first time in history it hasn’t happened. Markets go up and down all the time; and more times than not they trade well above or below “fair value.” Corrections are part of the game. It’s the nature of the beast.

QE has tightly tied the performance of gold to the stock market because the rise in stocks has been driven by the new money it has infused into “the market” – it’s a QE boom. So when stock values fall due to a tightening of money, gold will rise because tighter money does not automatically produce stronger money – because the underlying economy is weak.

Higher interest rates do not produce strong economies or currencies. That’s a false conclusion being made in the markets today. Instead, strong economies produce strong currencies and higher interest rates are a byproduct of that dynamic. Not the other way around.

Independent investors must guard against getting caught up in the dogma that this is a new “paradigm” where major market corrections aren’t possible, that gold has little value and profit potential, and that rapidly rising stock market values which in no way correlate to economic activity are totally legitimate. That’s a costly misnomer.

Based on current Market conditions and a rational market the Dow should be trading around 13,000 and gold should be about $2,000 an ounce. But logic is nonexistent in today’s investment markets.

In today’s market a few things are clear: the upward movements in the stock market have slowed down significantly, the trading range is tighter, and new highs are obtained more tepidly. That’s because traders know how toppy this market is. And that’s why they’re scared and moving to Treasuries.

Gold is currently $1,200 an ounce, but if markets and currencies were as strong as some are programmed to suggest, it would be trading much lower than that, perhaps half the going rate; and yields would be much higher, perhaps twice their current level.

Asset allocation is always key; patience is a virtue, and discipline is the bridge between goals and accomplishment – (Jim Rohn).

You should know that this is a dysfunctional market driven by easy money, irresponsible government spending and corrupt management; not economic wherewithal.

And believing otherwise is where the danger is, Will Robinson.

Stay tuned…