“The market” slipped on a banana peel this week and fell 579 points, or 3.5%; “strength” lost just 0.7%, and gold added 1.1%. Speculation about the cause of the adjustment is swirling, with many taking heads blaming it on deteriorating conditions in Emerging Markets.

First things first…

The Dow Average has been trading much higher than it has in its history. In fact, the Dow ended 2013 eleven-percent higher than it was valued at the peak of the tech-boom – when economic growth averaged a robust 6+% per year in Nominal terms. Today the economy is growing less than 2% in Real terms, whereas the tech-boom averaged 4.5% Real growth annually. Even after this week’s minor sell-off the Dow is still trading near an all-time high multiple to Real GDP.

The condition of the Market hasn’t changed: economic growth for the last six years has been mute; chronic unemployment is acting like a cancer to recovery; the level of big government welfare donations are draining a massive amount of worth from the middle class; and the world socio-political environment has been on the brink of destruction since the ’08 crash. “The market,” drunk on QE money, seemed never to consider these chronic conditions – until this week, that is, when it finally reacted with some chutzpah.

Is this the beginning of a major correction?

Perhaps.

Generally it’s easier to get your arms around the current environment when a wider view is taken. To recall some recent history, remember that U.S. economic growth had begun to slowdown in 2007, even though the Dow went on to an all-time high later that year (October), which was one year prior to the crash.

In ’08 the economy posted a Nominal gain (1.7%) but shrank in Real terms (-.3%), and stocks corrected severely to the downside late in the year. In 2009 the economy was in full-fledged recession, shrinking 2.8% in Real terms, with stocks hitting their bottom in March.

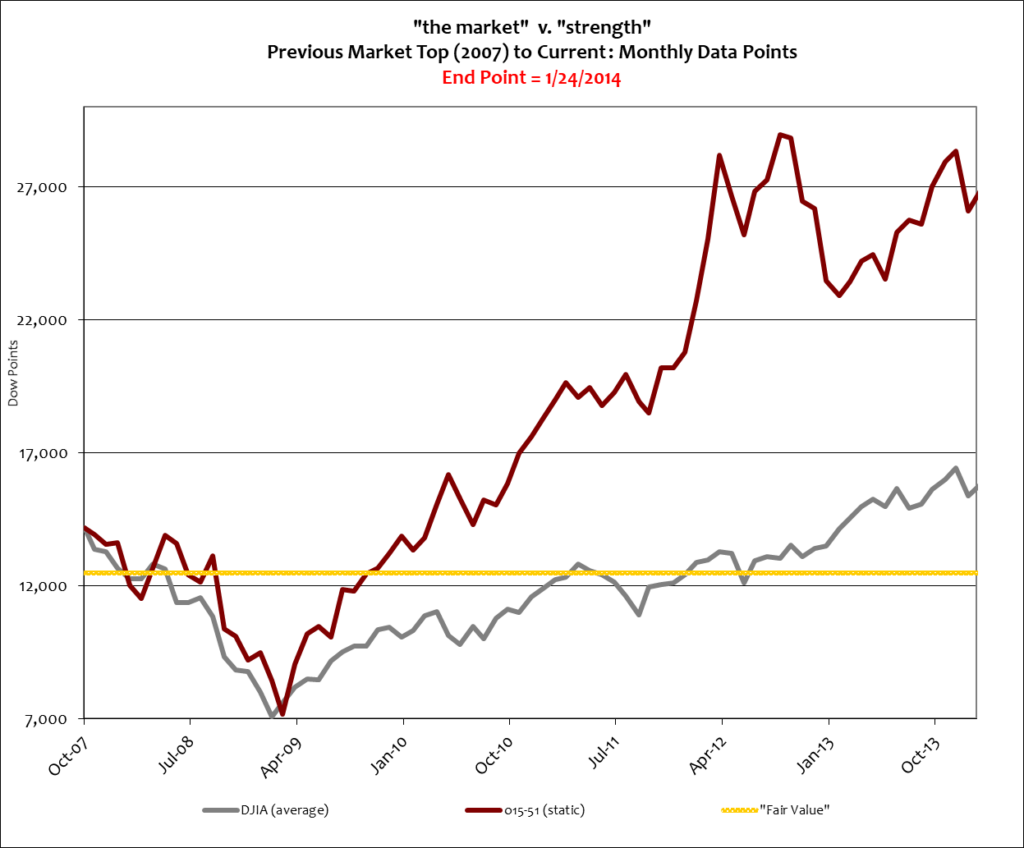

The economy recovered in 2010, as GDP grew in both Nominal and Real terms, 3.7% and 2.5% respectively. By 2011 stocks had regained “fair value” – the market multiple the Dow historically trades around – which is signified by the yellow line in the chart below. The chart begins when the Dow Average regained said fair value.

So in short: “economic recovery” took place in 2010 and stocks recovered in 2011.

Since that time the Dow Average has gained 13% per year; stock market strength via the 15-51 Indicator averaged 17% annual growth; while Real GDP advanced just 2% per year during the same time.

In a nutshell, stock market growth has greatly outpaced economic output for the last several years. And unlike the previous two booms (technology and housing) where robust economic growth pushed stocks higher, this “boom” is strictly driven by money – QE money to be specific – and the smoke and mirrors that go along with it. It’s purely inflationary.

These are things significant corrections are made of.

Instead, however, a media driven by the Wall Street machine attempts to advance the story that emerging markets are to blame, that deteriorating conditions in emerging markets are the world’s problem, and causing stocks to sell-off. If emerging markets are the true foil then I have a bridge to sell.

Remember when the subprime mortgage crisis was “isolated” to just a few rogue banks?

As detailed in LOSE YOUR BROKER NOT YOUR MONEY, the last “financial crisis” was a systemic problem driven by faulty U.S. government policies, cheap and easy money, and abuse and corruption throughout the financial industry. Losses and negative market impacts were incurred all over the world – but they began here, in America, the world’s largest economy.

Emerging markets simply don’t have the economic base to drive the U.S. market into a tizzy. They’re too small, and too insignificant in the grand scheme of things. However, weaker markets break long before bigger, stronger markets do. As such, they generally indicate a larger event – especially when the cause, or the disease, originates in a dominant market.

People seem to forget that it was persistently poor Market conditions and runaway inflation that spurred-on the revolutions in the Middle East and North Africa. Countries like Egypt, for example, import the majority of their wheat from the U.S. – so when American government devalues its currency in such a dramatic way and for such a prolonged period of time like it has, everything imported from the U.S. gets much more expensive in those emerging market economies. And when people must work all month to afford one loaf of bread, uprisings and overthrows of governments tend to fester.

According to current U.S. government, the answer to U.S. monetary devaluation that causes runaway inflation in emerging markets is foreign aid packages. Their hope is that foreign aid will offset the currency corruption of U.S. monetary policy. But these billions of dollars in foreign aid rarely get down to the Market level – to the People in those countries – as the aid money is funneled through corrupt governments, dictators, and/or radical militias.

Quantitative easing (QE) facilitates trillion dollar central government deficits, as the Federal Reserve prints new money and forces banks to lend it back to the central government (by mandating the purchase of U.S. Treasury securities.) That’s the reason the economy isn’t growing. Banks can’t lend to people and small businesses because they are forced to lend a majority of the new money to a central government that can’t afford itself – one that thinks handing out unaffordable foreign aid is a great counterbalance to poor monetary policy.

Look at the socio-political environment around the world and it’s easy to see that current U.S. foreign policy isn’t working.

Look at the lackluster performance of the U.S. economy and it’s easy to see that current U.S. domestic policy isn’t working either.

Look at the stock market and you will see runaway inflation that is looking to correct back to a reasonable economic worth.

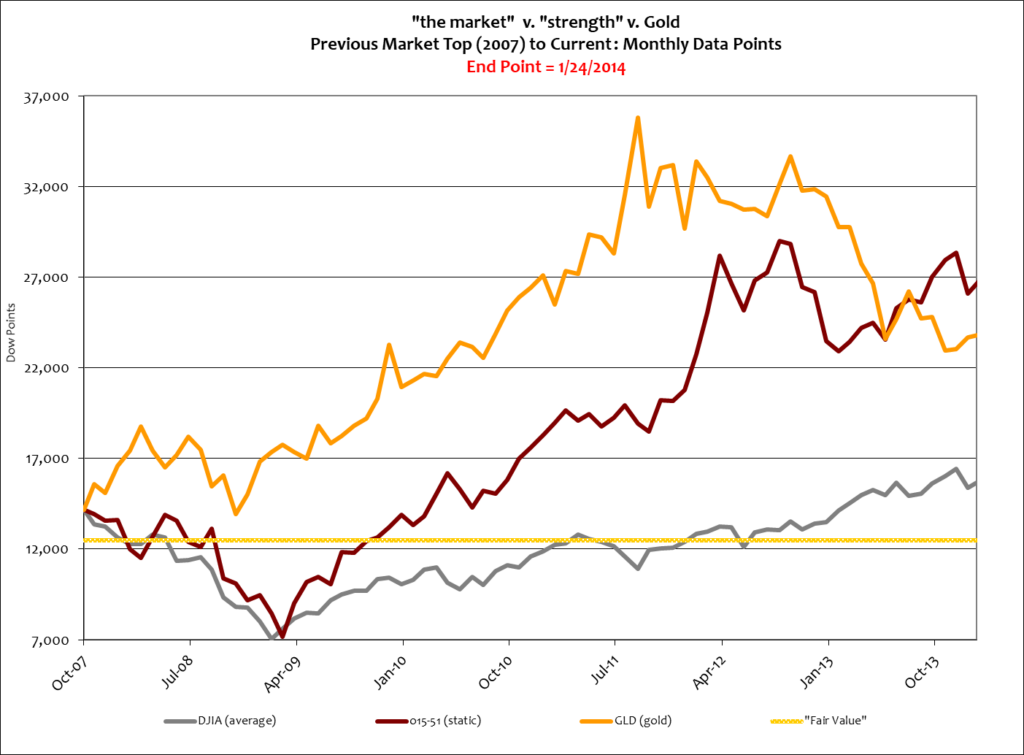

As mentioned previously, gold has been a leading market indicator since the housing-boom took steam. And since the current boom is a money-driven QE-boom, there’s little reason to think that gold won’t continue to indicate future stock market movements. A correction is due, no doubt, and according to gold it’s coming soon. Its history can be seen below.

“The market” is definitely telling us something.

The question is: Do you hear it?

Stay tuned…