Volatility has once again found the stock market – and again, contradictory new reports are at the core.

On Wednesday, October 22, 2014, the Wall Street Journal online posted an article entitled, Clouds Darken for America’s Blue-Chip Stocks, citing weak results for traditional powerhouse stocks like AT&T, Coca-Cola, IBM, Wal-Mart, and General Electric. The article went on to note that a collective one-third (or 66%) of the entire Dow Jones Industrial Average “posted shrinking or flat revenue over the past 12 months.”

Stocks fell 1% on that day.

But just one day later, on October 23, a contradictory article appeared in the same publication entitled, U.S. Stocks Rally on Strong Earnings. This article reported strong earnings performances by two key Dow components: Caterpillar and 3M. Those two stocks, just 7% of the Dow, lifted “the market” by more than 1% on Thursday; and then added another point on Friday, October 24.

Around the world poor economics continued to pour in – starting right here in America. On Thursday the U.S. Department of Labor reported worse than expected new jobless claims (283,000), and U.S. manufacturing fell short of expectations.

In China, the world’s second largest economy, growth was projected to “slow sharply during the coming decade,” while its “productivity [takes a] nose dive.” China’s new government continues to struggle making economic reforms and is currently facing a “deepening housing slump” and serious environmental and budgetary concerns.

A lackluster China hurts global output.

In the troubled Euro-Zone the first wave of earnings reports showed significant weakness – a grim outlook for their economy – especially now that the European Central Bank announced 25 of the Euro’s banks recently failed stress tests.

Not good.

With all the war and strife in the Middle East it’s easy to forget about their economies. Managing director of the International Monetary Fund, Christine Lagarde, hasn’t. She recently urged Persian Gulf countries to balance their budgets amid falling oil prices. Those countries, like Saudi Arabia, have been on a spending spree building critical infrastructure elements like roads, bridges, and hospitals to fend off radical sentiment and unrest stewing from the Arab Spring. A significant drop in oil prices will cause unsustainable deficits that will threaten their spending efforts.

And then who knows what will happen there.

Russia is in somewhat the same predicament. Already hampered by western government sanctions imposed for its actions in the Ukraine, a drop in oil prices greatly affects central government planning in that communist regime. For instance, Russia’s budget is predicated on an oil price of $100 per barrel. Oil is currently trading at $81/barrell. This kind of strain causes the specter of war to increase, as wartime conditions in oil rich nations threaten supply and raises prices – to thus increase revenues to oil dependent nations.

The world is on a collision course with calamity.

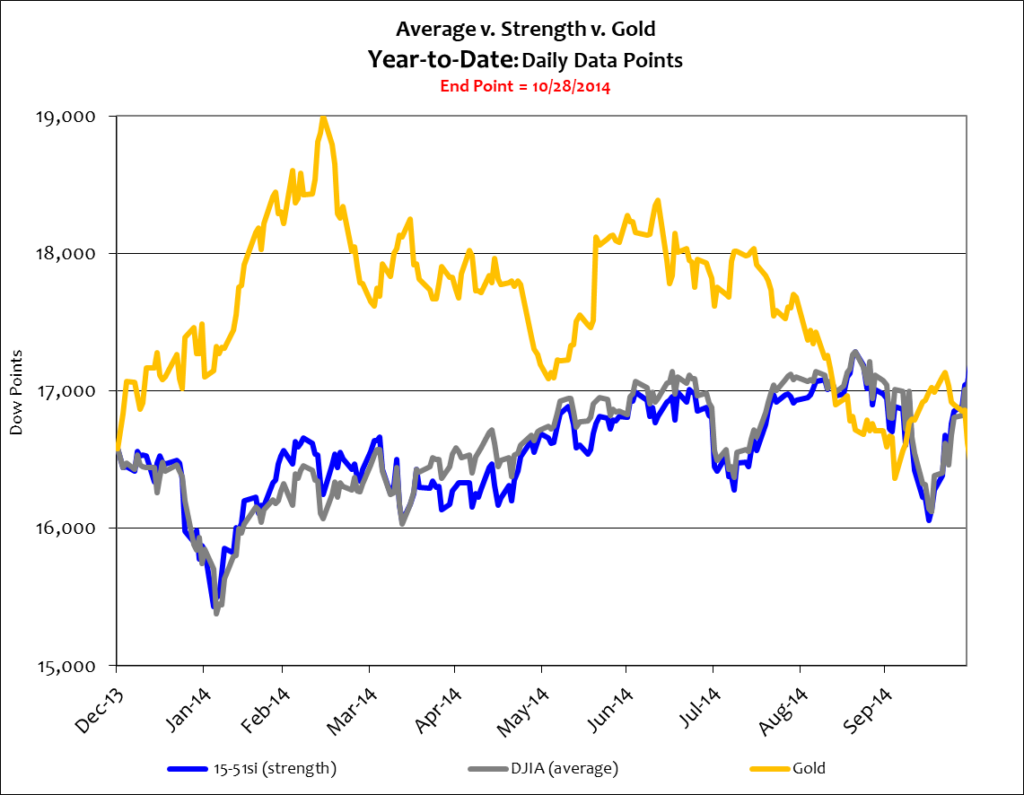

Yet the stock market appears not to see it. And while volatility has re-entered the equation, stocks and gold have produced little blood so far this year. See below.

Both stocks and gold have moved a lot so far but have really gone nowhere: the Dow Average is up just 1.4%, 15-51 strength has gained only 1.7%; and gold – down 11% from its year-to-date high – is higher by just 1.9% in the ten months.

Stocks and gold seem to be basing at these levels.

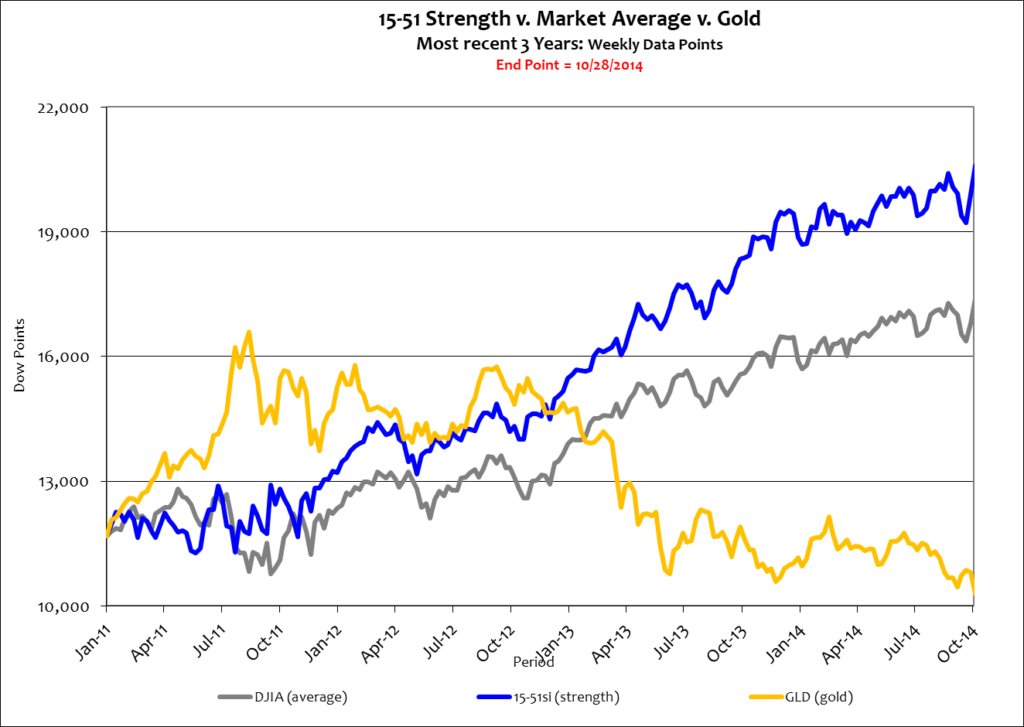

Perhaps that is more easily seen through a longer view. The chart below spans more than three years and begins when stocks essentially reached “fair value.” During this time 15-51 strength gained 70%, the Dow Average added 44% and gold lost 8%. See below.

During the period shown above the economy grew at just 7% in Real terms – just a few measly points per year. That puts the growth multiple for the 15-51 strength indicator at 10 times economic output, and the Dow Average’s at 6 times, or 600% of economic output.

That’s an unsustainable level of stock price inflation – which is the reason for increased market volatility – around the world.

Stay tuned…