I tore a bicep muscle and have been unable to type and blog. Now that I’m out of a cast and into a splint, I’m back in action.

Little has changed for the better since Records and Reality was posted more than a month ago. Global strife continues in the Middle East, Europe, and parts of Africa, and the specter of another major war engagement is omnipresent. This has forced the prices of oil and gas to move higher. These conditions – along with corrupt, incompetent, and inept U.S. leadership and management – will further pressure an already fragile world economy.

The biggest news since my last blog post is the substantial contraction of the world’s largest economy in the first quarter of the year. What was originally thought to be 1% first quarter U.S. growth, was later revised down to 1% shrinkage, and finally ended as a 3% drop in Real output. That’s a significant economic contraction! To put that malaise into perspective consider that the last time the market shrank at that pace was March 2009 – the quarter following the ’08 crash.

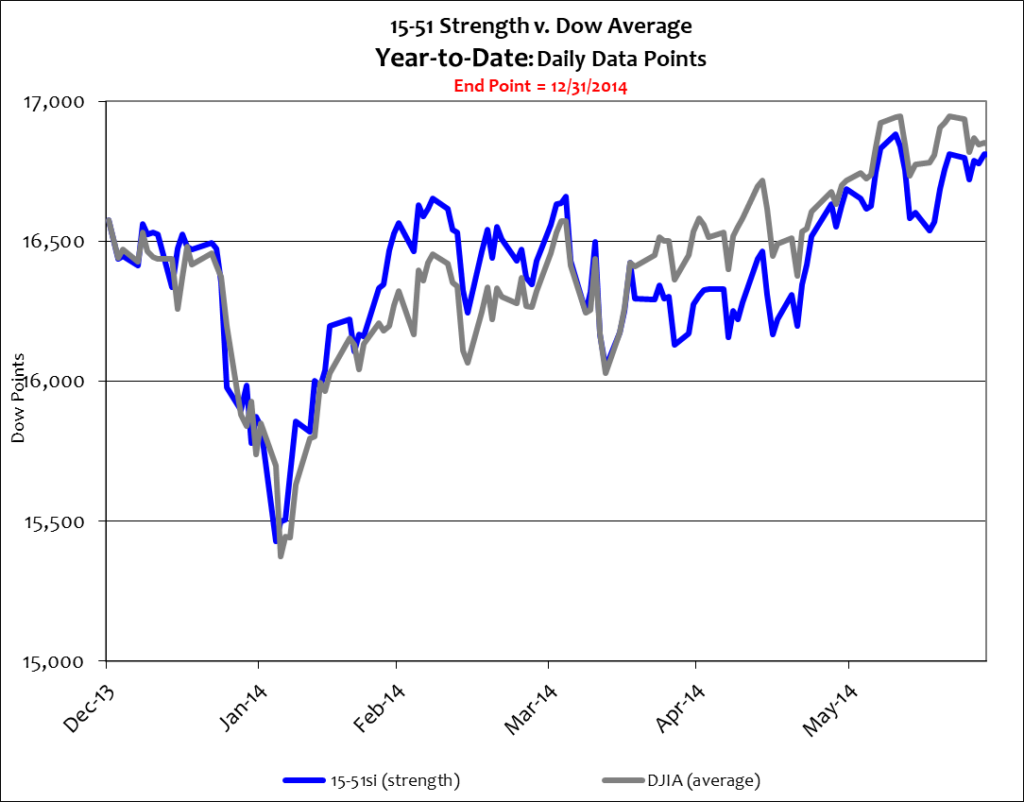

But again the stock market shrugged off the declining global picture. Below is a year-to-date comparison between the Dow average and 15-51 strength.

The market average has gained 1.7% while stock market strength added 1.4% so far this year – stellar performances considering the 3% economic shortfall.

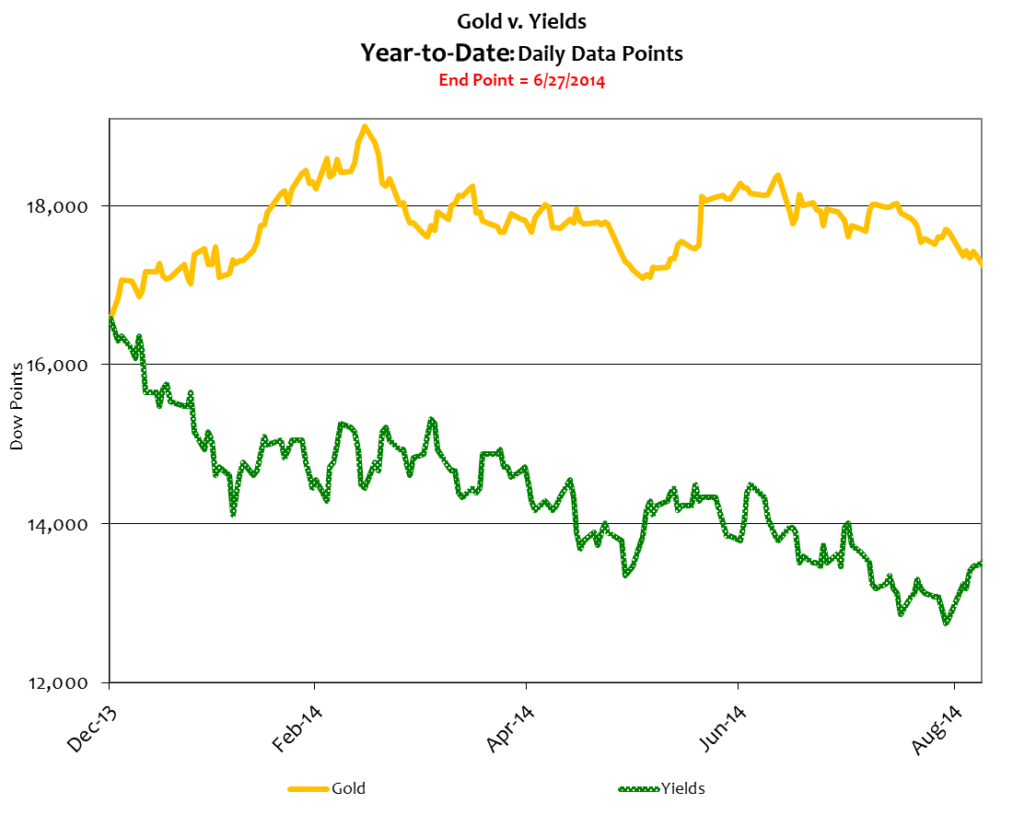

But hold on a second. Recall that bond yields rise during economic expansions and gold values fall. That’s the opposite of this year’s dynamic: gold is up and yields are down. Below is a year-to-date picture including gold and yields.

Here are a couple of things to take away from the above trends.

First, yields continue to fall despite the Fed’s QE tapering plan; they’re down 17% this year. Recall that QE is the process of printing new money and handing it to Wall Street banks who are then required to purchase U.S. Treasury securities with half of the new money. It should be noted that although there is less QE and mounting U.S. debt, the pace of debt has slowed. Instead of wracking up one-plus trillion of new debt every year the U.S. is now accumulating about $600 billion annually. So there is less QE and less debt, a condition that will continue to keep yields artificially low. But this is not the only condition for falling yields. Global strife and weakening economies push investors to the safety of U.S. bonds. That increased demand also puts downward pressure on yields.

And second, the next stock market correction will be spawned by a massive monetary and debt devaluation. That’s a condition ripe for gold; so every time stocks and money are threatened gold will rise. That said, it’s no big surprise to see gold rising when stocks are flattening and yields are falling.

Both yields and gold indicate weakening economic and monetary conditions. That is to say that stock valuations are out of step with the global economic condition.

So how can stocks remain near all-time high valuations?

Extortion.

Think of all the people that need interest income (a.k.a. yield) like senior citizens and/or retired people. These people can’t get it in the bond market because yields have been too low for too long. As a consequence, ultra conservative investors are extorted into finding income in the form of dividends in the ultra-risky stock market. These investors, compelled to find income in all the wrong places, will stay in the stock market until the consequence of correction forces them out. In other words, stocks will stay high until the seeds of correction begin bearing fruit.

At the time of the next correction the world markets will again be in disarray, another crisis will exist, and the establishment will once again steal wealth and liberty from the innocent. As with the last crisis, the next will produce more regulation, more taxes, more wasteful government programs, and more individual loss.

Panic selling during corrections ensures only one thing: a massive wealth transfer from individuals (including seniors and/or retired people) to the Wall Street establishment – those who make the Market for investments.

Exorbitant and prolonged QE programs have provided Wall Street banks with the clout to corrupt and inflate market indices to lure capital from wary investors. This inflation sets the stage for crisis; and when correction hits Wall Street market makers cash-in on the panic by buying low from investors desperate to get out – using capital reserves fortified by newly printed government cash accumulated from the extensive QE program.

Just because stocks are out of step with reality doesn’t mean you have to be.

Asset allocation and dry powder (cash) remain keys to long-term success.

Stay tuned…