Jun 14, 2015

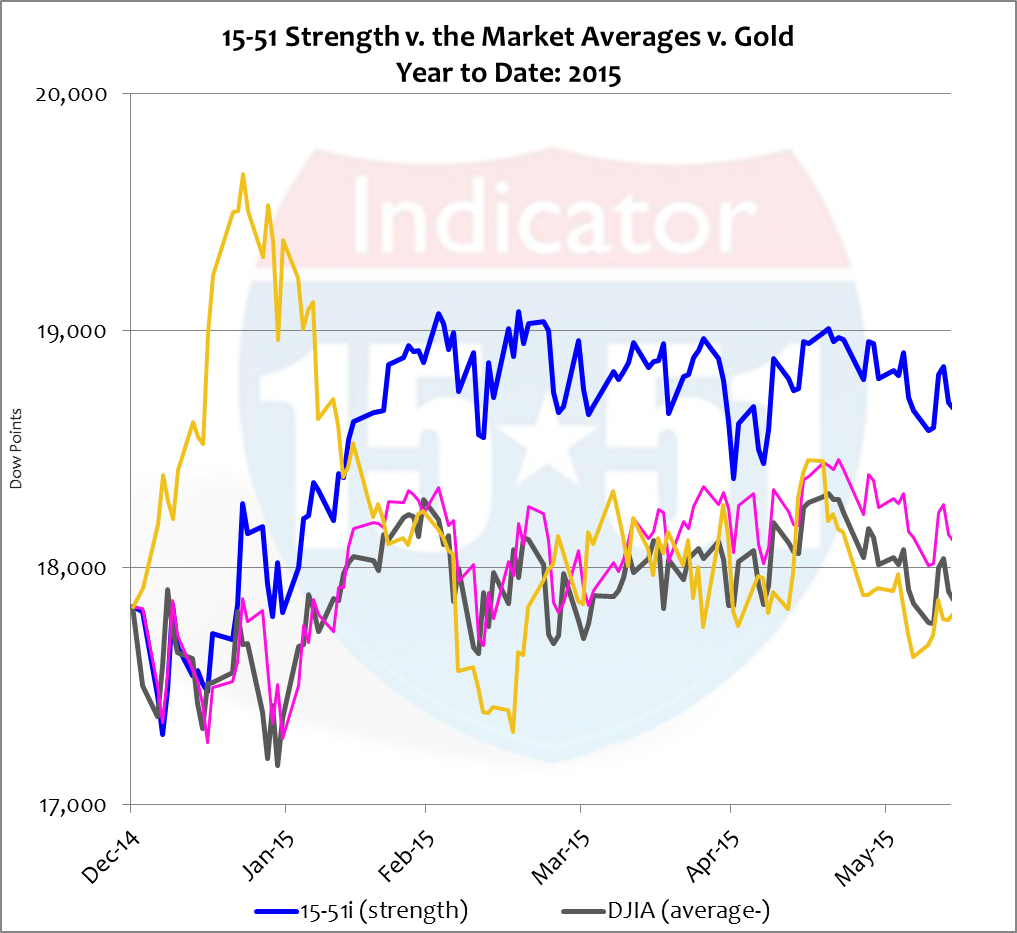

The prices for stocks and gold continue to oscillate to nowhere. Both the Dow Jones Industrial Average and gold are flat for the year. While those two benchmarks haven’t produced any growth so far, stock market strength via the 15-51 Indicator has gained a respectable 5%. See below.

Now that may not look like much, but 5% in a no growth market is five times better than the average. It also might not look like much because of the way the chart is scaled, starting at 15,000 and topping out at 23,000. That’s for a reason to be shown a little later. The point to takeaway here is that all stock market indicators appeared to have based at a top value, and seem unable to build higher valuations. That’s because the economy can in no way substantiate them.

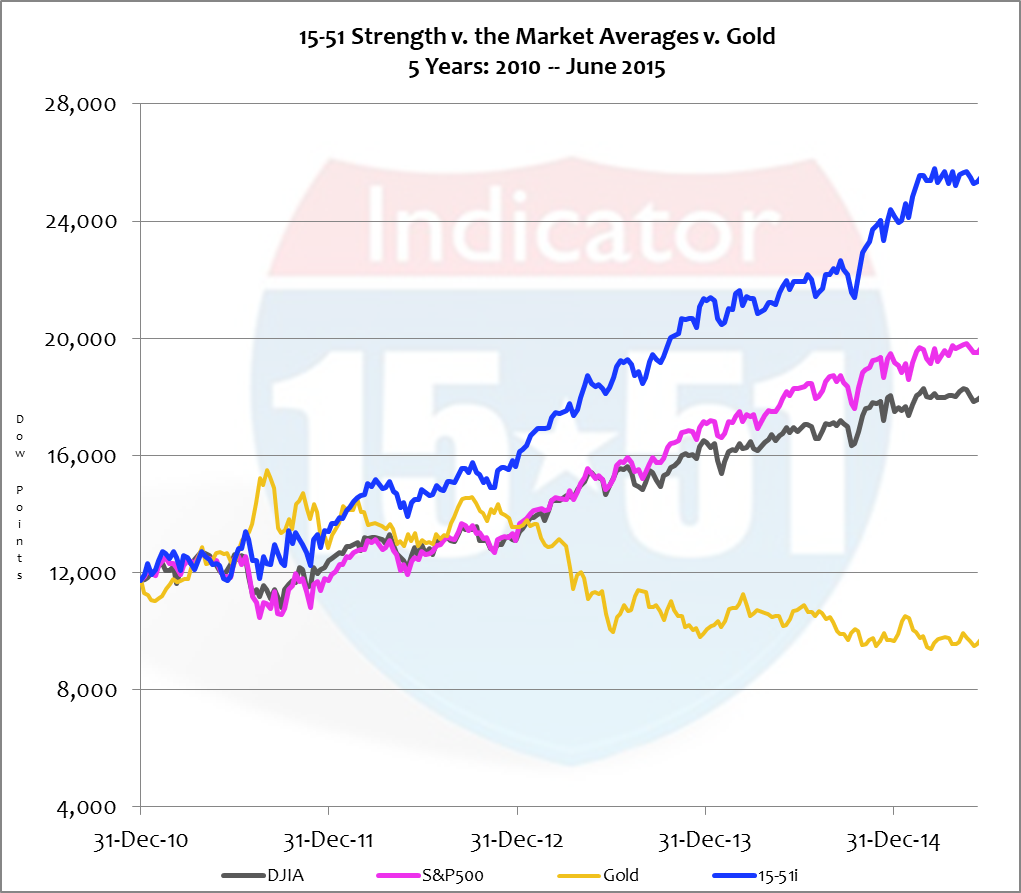

In the same vein, gold has based at a bottom valuation and seems unwilling to move significantly lower than its current value (the GLD is at $113.) Gold’s low valuation base can be seen more clearly in a chart with a longer timeframe. See below.

All of these trend lines have really flattened out over the past several months. Flattening trend-lines can be perceived two ways: as stability, or as the calm before the storm.

Stocks are indicating a no growth condition for the economy – or at best a growth rate that can’t substantiate higher stock valuations. Rightfully so. And while stock indices might appear stable, they are actually waiting for a trigger to move. Call it a calm before a storm. And where is that storm brewing?

The bond market.

In an article entitled, Bond Yields Hit 2015 Highs Across Globe (June 10, 2015), the Wall Street Journal reported that Germany’s 10 Year yield has moved over 1% – one percent. That’s big news, right?

Quietly, U.S. yields have also moved higher. Exactly two months ago the U.S. 10 year was at 1.85%. Today it’s at 2.4%. That upward move matches the 30% increase German yields have experienced. And though yields are rising, they still have a ton of room to go higher.

That’s that proverbial risk in bonds that has been mentioned in these blogs repeatedly, and most recently in, Just Ask the Greeks. Heck, you don’t have to be a rocket scientist to know that when global yields are just one point off their zero-percent bottom that they have no choice but to move higher.

When yields rise bond values fall.

And because yields have an infinite amount of space to move higher and just a point or two to move lower, bond values have and infinite amount of space to move lower and just a smidgeon of space to move higher. That’s what makes bonds such a high-risk proposition at this point in the cycle.

And why have yields moved so swiftly recently?

The world bond markets are reacting to the possibility of a major Greek default, again. And why hasn’t their problem gone away? Because the Greeks haven’t changed their operating model. They continue to burn bailout money without remedy. Every time a new agreement is reached between their creditors the problem temporarily goes away and global markets relax. Once the latest tranche of bailout money depletes, risk of default resurfaces and markets freak out – again.

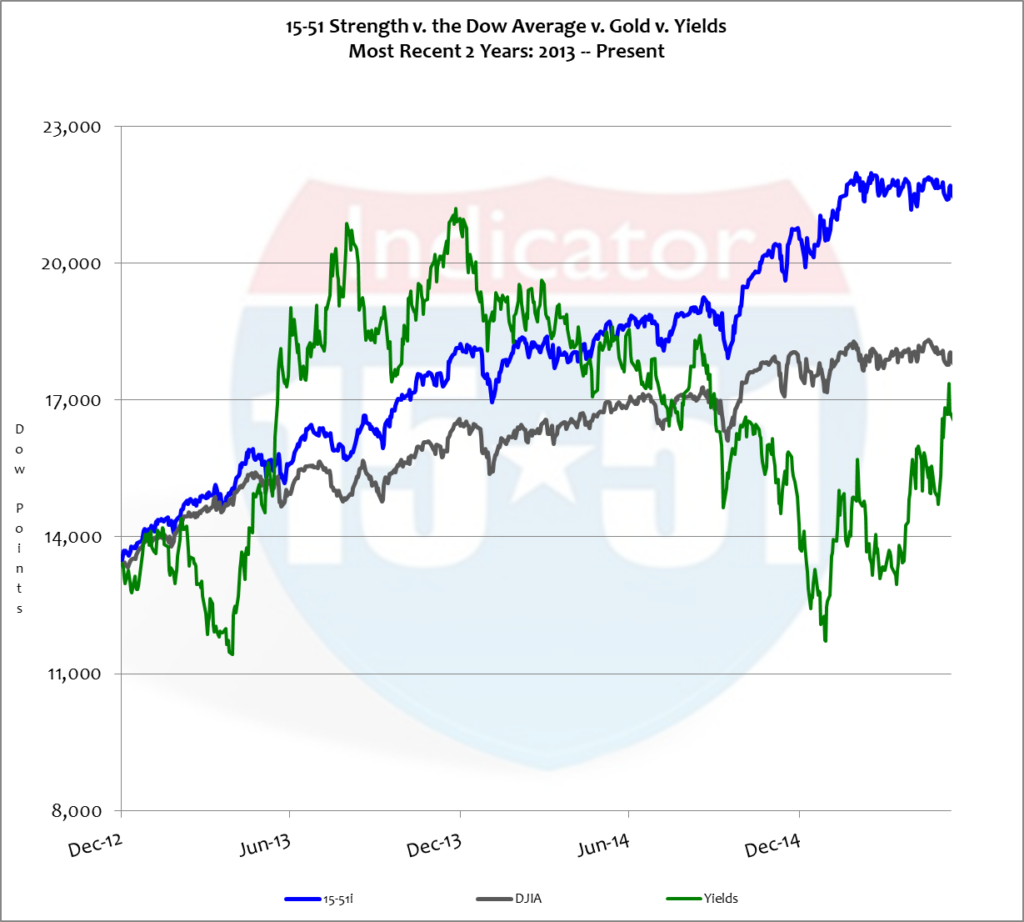

A Greek default will most likely be followed by its departure from the Euro, and that will throw markets into a real tizzy. Bond values, which run in an opposite direction of yields, are already erratic. But investors haven’t seen anything yet. The chart below is on the same exact scale as the first one shown in this blog. This will help differentiate the perceived stability in stocks and gold versus the volatility in bonds. As stated previously, yields have been forced low via quantitative easing (QE). As a result of this prolonged artificial stimulus they have yet to find a natural base.

So here is what you have right now in the markets. Stocks and gold are flat and bond values are plummeting. Even so, bonds are not low here; and even though they are correcting doesn’t mean it is a time to buy them. They are high. And the reason they are high is because yields remain at historic lows.

The concept of Buying Low and Selling High doesn’t purport to doing so blindly. Bonds are correcting, indeed, but they are still high with much room to move lower. The same is true with stocks; they are high and have more room to move lower than higher.

Commodities that run contrary to monetary value are still low. That is to say that gold is as much of a buy at these levels as bonds are a sell. But like all investments, decisions to invest now in those kinds of markets must be long term in nature.

To put it plainly, these are the worst types of Market conditions to make money in. Everything is high risk, be it short or long term. The reason for that is the combination of extremely high valuations and a fragile underlying economy. And that won’t change until Market conditions change.

For investment, investment profit comes much easier when it is easy to make money in the marketplace – when unemployment is decreasing, labor participation is increasing, and wage growth is robust. That’s the way it goes.

Until then keep an ample amount of powder dry. It’s cloudy out there and a storm is due.

Stay tuned…