As the stock market continues to bounce around record highs a few things remain clear: the global economy remains fragile, growth is weak and uneven, and the job market isn’t getting any healthier – despite the falling unemployment rate, which recently dropped to 6.3% from 6.7%.

In a healthy and functional market, unemployment falls while labor participation rises. But that’s not happening in today’s market. In the recent employment report, labor participation dropped by the same fraction as the unemployment rate did. Both went down. That’s a contradictory condition to the norm. It’s a sign of illness.

Labor participation is currently 62.8%, and it hasn’t been this low since the Carter years of the 1970’s. As a basis of comparison, labor participation averaged 67% during the Clinton ‘90’s. This lower production makes it impossible for the economy to expand in any meaningful way. Too many people have simply left the labor force.

That’s a terrible economic fundamental.

A few weeks ago the U.S. reported anemic growth in the weather-torn first quarter, just .1%. Not long after, the European Union also reported dismal GDP performance. The Euro-Zone economy posted a slightly better .2% increase in market activity. This weakness prompted EU central banker, Mario Draghi, to strongly reaffirm his readiness to act – and act aggressively – to bolster the E-Zone economy and fight deflation (a general decrease in prices).

One problem: Draghi will be employing the same kind of stimulus programs that haven’t worked here in the U.S. And it won’t work there either.

The trouble with the global economy isn’t that central bankers haven’t printed enough money; it’s that they put the money into the wrong hands – and then tied all the wrong strings to it. For instance, by handing the new money to Wall Street banks and forcing them to buy a certain amount of Treasury securities with it, the Federal Reserve has facilitated an unprecedented amount of government spending and waste by way of historically low yields.

That doesn’t do the mom-and-pop shop, or you and me, any good – and that’s the reason deflation continues to be a macro economic threat.

Consumer demand and wage growth are weak, and because the new money hasn’t reached people and small businesses, the new money hasn’t circulated through the economy to expand employment and push prices higher. Instead, the spare new money (that is, new money not used to purchase Treasury securities) has remained under the control of the investment banks on Wall Street.

And what do they do with it?

They invest it – and that’s the reason the stock market is near all-time highs (a.k.a. inflation). In fact, the stock market is valued almost 10% higher than it was during the tech-boom – when the economy was growing 6% per year, unemployment was 4%, and labor participation was 67%.

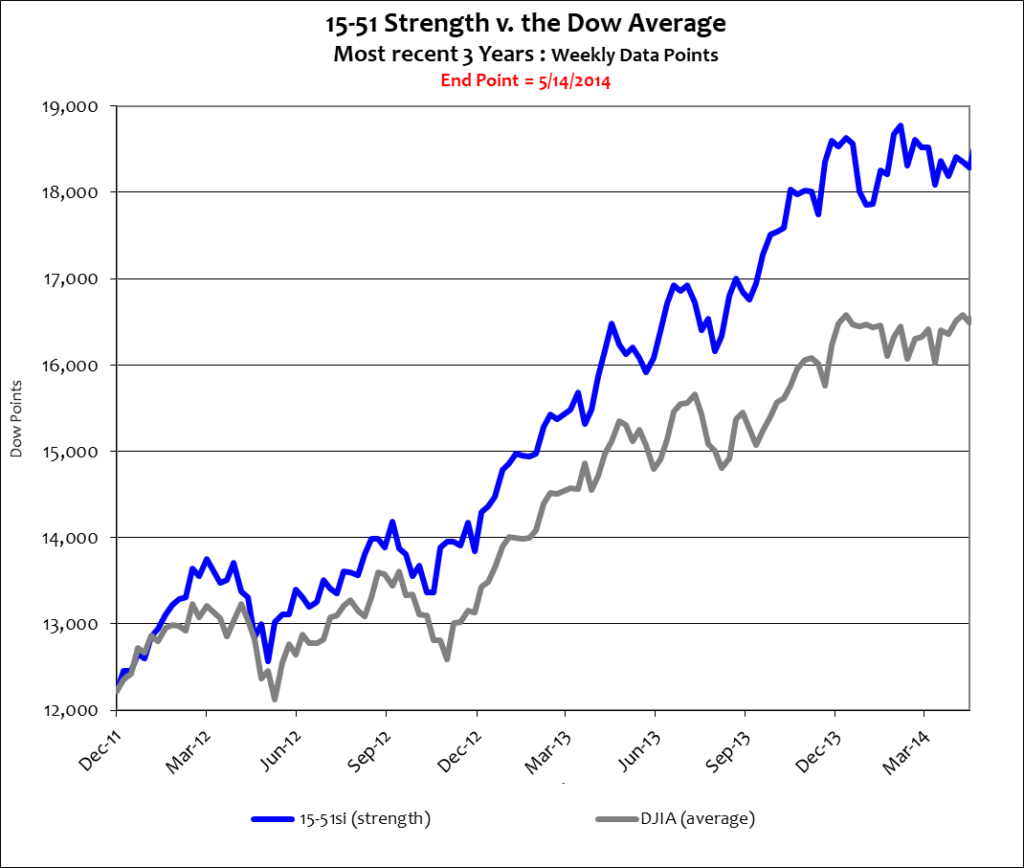

This continues to be a smoke and mirrors stock market rally. See below.

Since regaining fair value in 2011, the Dow Average has gained 35% and 15-51 strength added 50% – under a flat-lining economy, unprecedented government debt and corruption, and the worst job market since the 1970’s.

In short, stocks have risen dramatically without any economic foundation – and the higher they go, the harder they’ll fall.

The next correction will be an extremely ugly one.

Stay tuned…