The S&P 500 closed the month at another all-time high, ending over 2,000 points for the first time in its history. The Dow Jones Industrial Average and the 15-51 strength indicator also remain extremely elevated, though a shade off their respective all-time highs. Stocks are still hot, no doubt – and so are bonds.

Yields continue to fall. The ten year U.S. Treasury is now at just 2.34%; and in a recent auction across the pond Germany sold $5 billion of two year bonds at zero percent. This dynamic (falling yields and rising bond values) indicates economic weakness. That’s a different picture from the stock market, where its high and rising stock prices are indicating economic strength.

Which is telling the right story?

Truth be told, the global economy is flat. The entire Euro Zone (a collection of markets that place it as the world’s second largest economy) reported zero growth in the most recent quarter; and Germany, its largest economic component, contracted in the quarter.

While it is true that the world’s largest economy posted a “strong” second quarter (4% annualized growth), America’s first quarter performance was dismal (-3% annualized contraction). This is not to mention that early indications for third quarter market activity aren’t so good: July retail sales were flat and consumer spending declined. All of this puts the U.S. economy on pace to grow at best 1% for this year – a no-growth condition.

And then there is escalating global strife. Russia stepped up its aggression in the Ukraine and according to President Obama the U.S. has “no plan” to counter global terror threat, ISIS, who is destabilizing the entire Middle Eastern region – you know, where much of the world’s oil supply resides. Those two aggressions, Russia and ISIS, threaten the top two economies through energy price and supply instability.

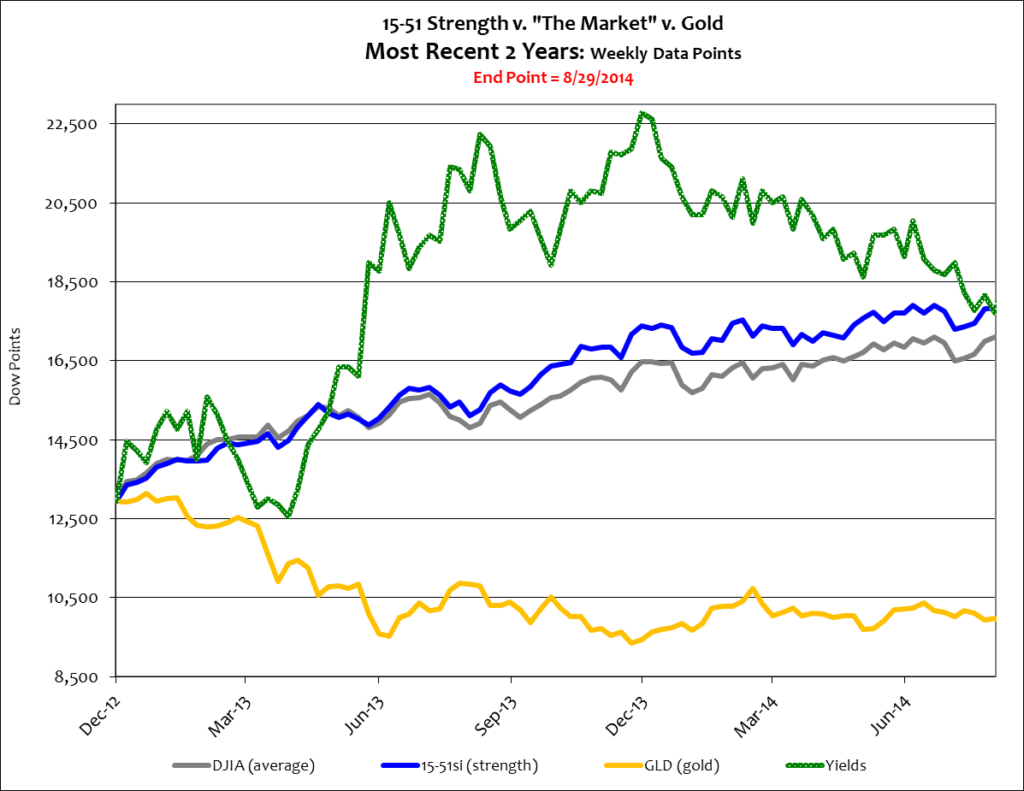

Bonds indicate this peril (yields are down 15% in the most recent twelve months) but stocks seem not to care. The Dow Average is up 15% in the same time and 15-51 Strength has gained 18%. See below.

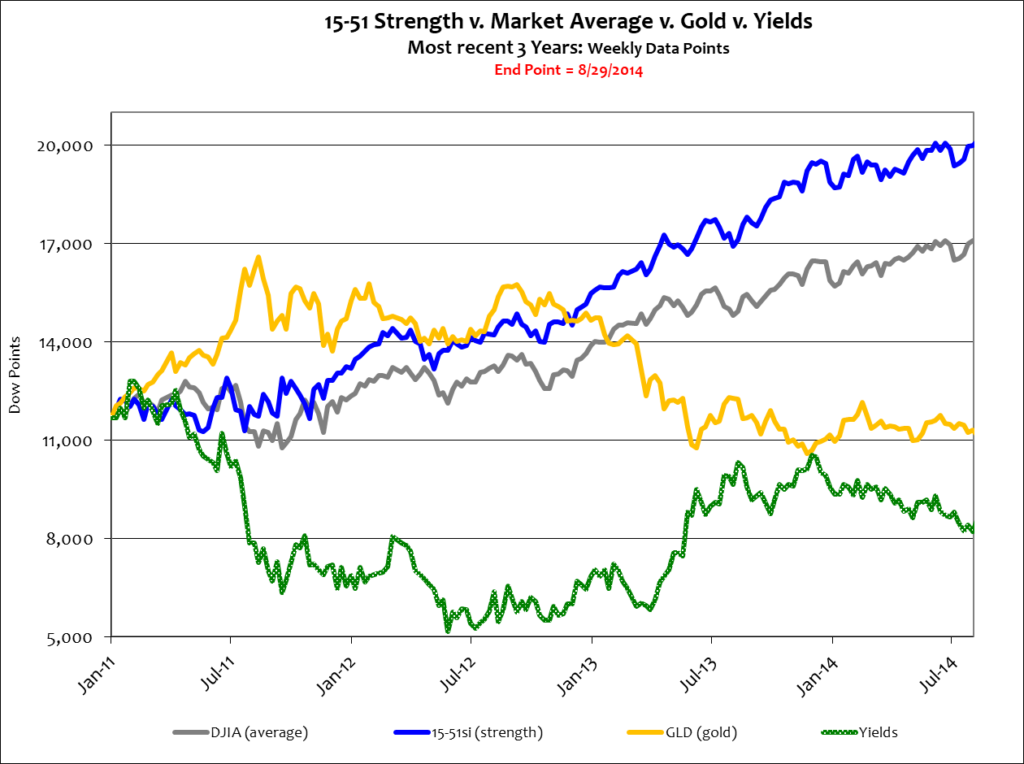

Among other things, falling yields signify an increase in demand for them. With rates as low as these, and by lending money to “safe” governments like Germany and the U.S., the message investors are sending is that their appetite for risk is mute and principal protection is more important than return on investment. Why else would investors flock to the safety of low yield bonds while the stock market has been gaining 15% per year for three years running? See below.

The stock market looks strong, but as the bond market shows, many investors have little confidence in it. The reason for that is simple.

Massive regulations and taxes strangle an economy. Global strife closes some markets, threatens others, and extorts still more. All of this leads to a higher tax environment and minimizes room for free-markets to operate and profit – which is a goal, of course, of central government planners and social justice advocates. To them, and to terrorists, the free-market is a common enemy.

The problem with fiscal “stimulus” and burgeoning social welfare is that they’re short-term in nature and do nothing to expand the Market, freedom, and prosperity. For instance, when roads are repaired the economy temporarily expands by the amount of labor and materials used during the process. However, once the project is completed the economy shrinks by the same amount. Indeed, the process can be repeated again and again to artificially inflate an economy; but the results will always be the same: a short-term burst of economic activity.

The same can be said for irresponsible expansions of social welfare programs like food stamps, subsidized housing, healthcare, and unemployment. Indeed, this may increase money available to circulate in the economy; but it creates dependence, minimizes the market to need-based spending, corrupts pricing, and lasts only as long as the next congressional budget. Social welfare programs take hard earned dollars from free people against their will and places it in the hands of others according to the political agenda of central government planners. These actions control, manipulate, and corrupt free markets while incubating an environment of higher taxes and tariffs.

By taxing producers to benefit takers (i.e. central government planners and social welfare recipients), the government limits the amount of capital available to expand Markets. This diminishes the free-market and expands the authority of central government planners with corrupt agendas. (PS: Approximately 40% of Americans are now on some form of social welfare.)

Terrorists like ISIS take control of markets through force. They seize oil fields, airports and rights of passage, and private property; then through a central hierarchy of government dictate what products can be produced, sold, and distributed – to whom, when, and in what quantity. They excessively tax the populous under their control and dictate market growth and wealth redistribution according to their political agenda – a complete diversion from free market principles.

Central government planning, in any form, is too corrupt, political, and inefficient to have a dominant role in a robust economy. For proof of this follow the money…

The Federal Reserve’s quantitative easing (QE) program, for instance, was a multi-trillion dollar effort – a dominant position in the financial marketplace. Its purpose was to keep interest rates at historic lows to incentivize borrowing and robust market expansion (a demand-side approach). As usual, success again eluded them.

Simply put: the Fed printed new money and handed it to Wall Street banks under the condition that half the money had to be used to finance central government deficit (U.S. Treasury securities); the other half could be used any-which-way.

In practice we have seen the central government get their dominant share (the national deficit is now $9+ trillion higher and the economy hasn’t moved), and the other half went God knows where. However, one thing is for sure: it never got down to small U.S. businesses and entrepreneurs (see: Small Business Lending is Slow to Recover, Wall Street Journal on-line, 8/17/2014).

Free markets are where prosperity resides. Long-term growth is derived from new businesses, new products and service lines, and a vibrant consumer base – all of which require money (capital) and freedom. Entrepreneurs, free from government intervention, are the most effective and efficient investors in new ventures that add long term employment. But they haven’t been able to get the money during this “recovery.” Why?

Interest rates were too low and provided too little incentive for Wall Street banks to supply debt to small American businesses; so they looked overseas for higher yields (see: Your Money and Argentina). Fortification of this point arrived just today, September 1, 2014, as news broke that Goldman Sachs lent $835 million to Portuguese lender, Banco Espirito Santo, just one month before it failed (see: Too Little Room). It was a desperate attempt at realizing higher yields, which is what happens when central planners look at only one side of the market equation (in this case, the demand side.)

The Fed’s low yield policy hasn’t helped American business, the American people, or the American market. One can only wonder: What are they really trying to do?

Consider that Wall Street banks are currently lobbying the Federal Reserve to delay a portion of the Dodd-Frank financial regulation called the Volker Rule, which limits the amount of money Wall Street banks can invest in high-risk private equity ventures. This portion of Dodd-Frank is good. Why should Wall Street banks have the freedom to invest in high risk ventures when they can get bailed-out by taxpayers should those investment go bad? – And let’s face it, much of that money came from the Federal Reserve via QE. That’s not their money, it’s ours: We the People.

Shame on the Fed if they cave.

But the chess match of corruption between the government and Wall Street runs much deeper than misplaced money. On August 12, 2014, two stories crossed the Wall Street Journal wires: SEC Launches Examination of Alternative Mutual Funds, and Banks Retreat from Market That Keeps Cash Flowing. Isn’t that interesting? One government agency is investigating “alternative” mutual funds sold by Wall Street for possible criminal action, and in retaliation thereof, the Wall Street establishment is abandoning another government agency’s “alternative” investment tool to keep interest rates low – the Federal Reserve’s reverse repo (see: QE Forcing Fed’s Hand).

In any event, the Federal Reserve won’t be happy about Wall Street’s stance on the repo; they feel they need the repo market to unwind QE.

In a similar vein, and because QE is ending, the Wall Street establishment feels they need to sidestep the Volker Rule to unwind more high risk investments. Remember, under QE the Wall Street establishment sold “toxic” investments to the Federal Reserve in exchange for the newly printed money.

So a deal between the two villains will most likely be struck. They need each other. And it doesn’t matter if their action goes against the best interests of the American People, again.

That’s how big government central planning is bad for We the People. They only look at one side of the equation.

Theirs.

Stay tuned…